TN DoR FAE 170 2008 free printable template

Show details

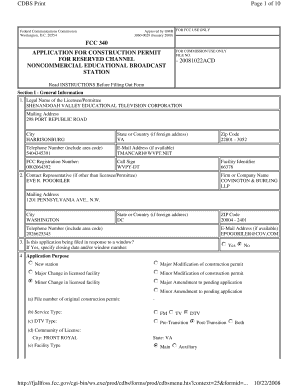

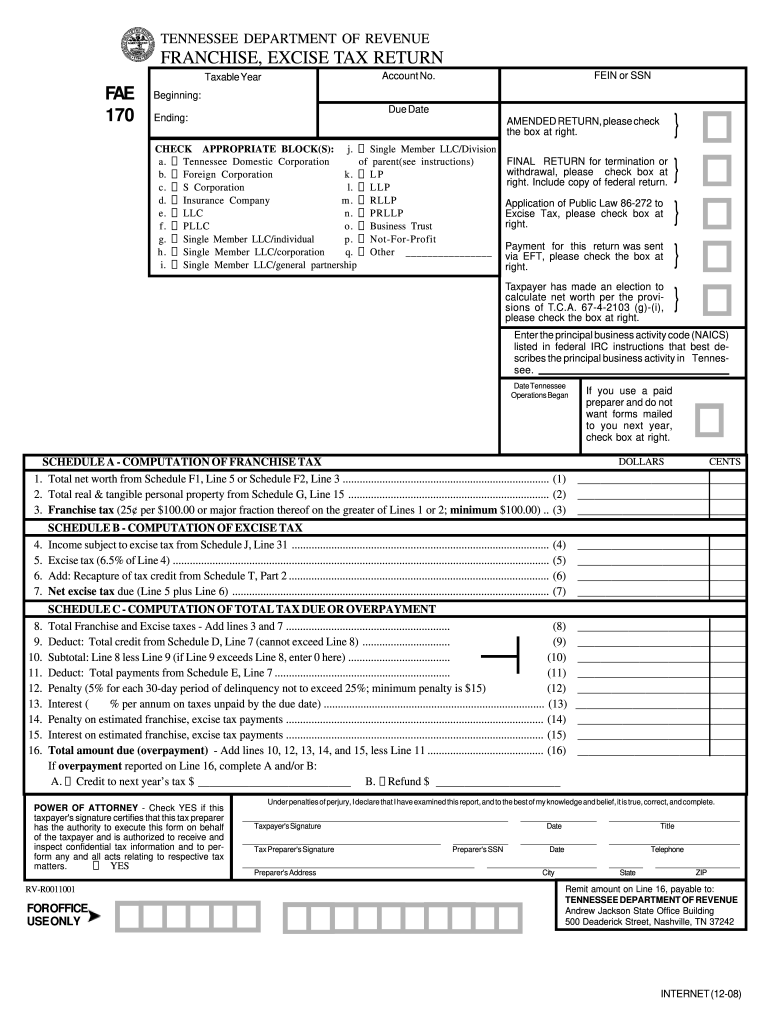

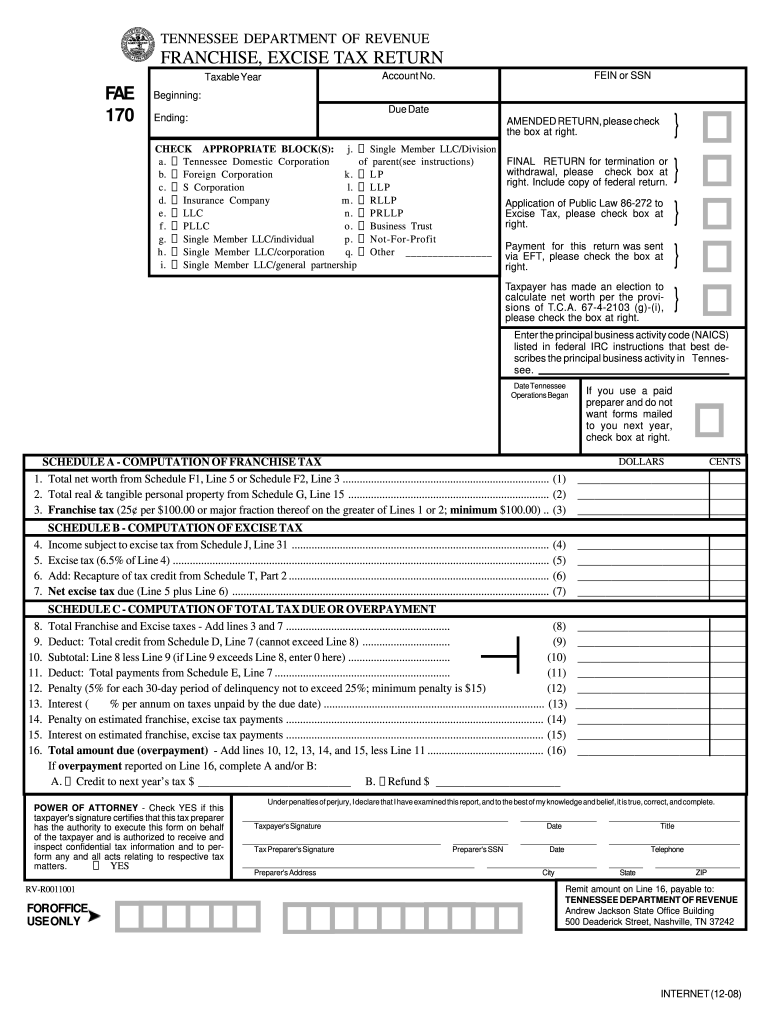

C. A. Section 67-4-2009 4. SCHEDULE T FORM FAE 170 - SCHEDULE OF INDUSTRIAL MACHINERY PART 1 TAX CREDIT COMPUTATION Purchase price of machinery. Schedule L - FEDERAL INCOME REVISIONS Year 1. Original Net Income 2. Net Income 3. Increase Decrease on Federal Return Corrected Affecting Excise Tax ALLOCATION AND APPORTIONMENT SCHEDULES SCHEDULES M THROUGH R FORM FAE 170 TAXPAYER NAME IMPORTANT IF YOU USE THIS FORM ATTACH IT TO YOUR FRANCHISE EXCISE T...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign tn 170 form

Edit your tennessee department of revenue forms form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tennessee form fae 170 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tennessee fae 170 instructions online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit fae 170 form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TN DoR FAE 170 Form Versions

Version

Form Popularity

Fillable & printabley

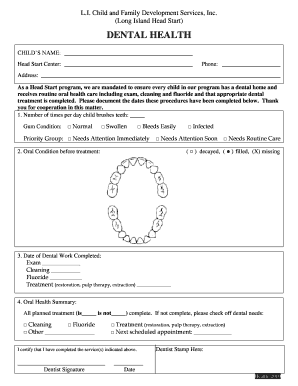

How to fill out fae170 form

How to fill out tn form 170:

01

Obtain a copy of tn form 170 from the appropriate source.

02

Read the instructions on the form carefully to understand the requirements and any supporting documentation needed.

03

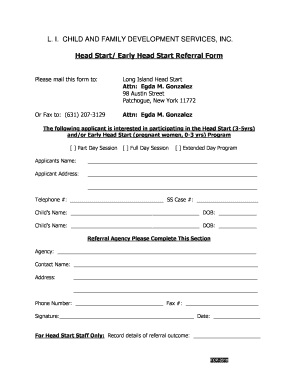

Begin by filling out the personal information section, providing your name, address, contact details, and any other requested information.

04

Proceed to fill out the specific sections of the form related to your situation or purpose for filling it out. These may include sections for income, expenses, assets, liabilities, and any other relevant information.

05

Double-check all the information you've provided to ensure accuracy and completeness.

06

If required, attach any supporting documents or additional forms that are necessary to complete tn form 170.

07

Sign and date the form in the designated area.

08

Make a copy of the filled-out form for your records before submitting it to the appropriate entity.

Who needs tn form 170:

01

Individuals or businesses who are required to report their financial information for a specific purpose.

02

It may be needed by taxpayers, organizations, or government entities for tax purposes, financial reporting, loan application, or any other legal requirement.

03

The specific need for tn form 170 may vary depending on the jurisdiction or specific circumstances involved. It is essential to consult the relevant authorities or seek professional advice to determine if you need to fill out this form.

Fill

form

: Try Risk Free

People Also Ask about

Who must pay TN business tax?

Business tax consists of two separate taxes: the state business tax and the city business tax. With a few exceptions, all businesses that sell goods or services must pay the state business tax.

What is FAE 170?

FAE170, franchise tax, excise tax, franchise & excise tax form, Franchise & Excise Tax Return, corporate taxes before 1/

Who is exempt from TN franchise tax?

There are numerous exemptions for F&E purposes that allow an LLC to not be taxable. The most common exemptions are: Family-owned non-corporate entity (“FONCE”) Farming or the holding of a personal residence.

Does Tennessee have a franchise tax?

Franchise tax – 0.25% of the greater of net worth or real and tangible property in Tennessee. The minimum tax is $100.

How do I avoid franchise tax in Tennessee?

Seventeen different types of entities are exempt from the franchise and excise taxes. Industrial Development Corporations. Masonic lodges and similar lodges. Regulated Investment Companies owning 75% in United States, Tennessee, or local bonds. Federal and state credit unions. Venture Capital Funds.

How do I file franchise and excise tax in Tennessee?

Online Filing - All franchise & excise tax returns must be filed and paid electronically. Please visit the File and Pay section of our website for more information on this process. Paper returns will not be accepted unless filing electronically creates a hardship upon the taxpayer.

Does Tennessee require estimated tax payments?

Estimated tax payments? Individual filers in TN do not have to file estimated quarterly payments. Businesses, including Tennessee LLCs, with a combined franchise and excise tax payment of more than $5,000 are required to make quarterly payments.

Where do I mail my TN franchise and excise tax return?

Return Mailing Address: Tennessee Department of Revenue: Andrew Jackson State Office Building. 500 Deaderick Street. Return Mailing Address without Refund: Tennessee Department of Revenue : Andrew Jackson State Office Building. Amended Return Mailing Address: nt of Revenue : Andrew Jackson State Office Building.

What is Tennessee business tax based on?

The franchise tax is based on the greater of net worth or the book value of real or tangible personal property owned or used in Tennessee. The excise tax is based on net earnings or income for the tax year.

Who must file Tennessee franchise tax return?

Overview. If you are a corporation, limited partnership, limited liability company, or business trust chartered, qualified, or registered in Tennessee or doing business in this state, then you must register for and pay franchise and excise taxes.

Who is subject to Tennessee franchise tax?

All entities doing business in Tennessee and having a substantial nexus in Tennessee, except for not-for-profits and other exempt entities, are subject to the franchise tax.

Is Tennessee business tax same as franchise tax?

Tennessee has both an excise tax, which is a tax on net earnings, and a franchise tax, which is a tax on net worth. Both of these taxes apply to most Tennessee businesses other than general partnerships and sole proprietorships. At the same, and as mentioned above, Tennessee has no personal income tax.

Who must file a Tennessee business tax return?

Overview. Generally, if you conduct business within any county and/or incorporated municipality in Tennessee, then you should register for and remit business tax. Business tax consists of two separate taxes: the state business tax and the city business tax.

Who is exempt from Tennessee business tax?

Certain entities under specific circumstances are exempt from paying the business tax. These may include, but are not limited to, people acting as employees, manufacturers, religious and charitable entities selling donated items, direct-to-home satellite providers, and movie theaters.

Who must file a Tennessee franchise tax return?

Overview. If you are a corporation, limited partnership, limited liability company, or business trust chartered, qualified, or registered in Tennessee or doing business in this state, then you must register for and pay franchise and excise taxes.

How to file a franchise and excise tax return in Tennessee?

Online Filing - All franchise & excise tax returns must be filed and paid electronically. Please visit the File and Pay section of our website for more information on this process. Paper returns will not be accepted unless filing electronically creates a hardship upon the taxpayer.

Who is subject to TN business tax?

Generally, if you conduct business within any county and/or incorporated municipality in Tennessee, then you should register for and remit business tax. Business tax consists of two separate taxes: the state business tax and the city business tax.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get TN DoR FAE 170?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the TN DoR FAE 170 in a matter of seconds. Open it right away and start customizing it using advanced editing features.

Can I create an electronic signature for the TN DoR FAE 170 in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your TN DoR FAE 170 in minutes.

How do I edit TN DoR FAE 170 on an Android device?

You can make any changes to PDF files, like TN DoR FAE 170, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is TN DoR FAE 170?

TN DoR FAE 170 is a form used for reporting and detailing information related to certain business activities and taxes in Tennessee.

Who is required to file TN DoR FAE 170?

Businesses and entities engaged in specific activities in Tennessee that require reporting certain tax information are required to file TN DoR FAE 170.

How to fill out TN DoR FAE 170?

To fill out TN DoR FAE 170, you need to provide accurate information regarding your business activities, financial data, and other relevant tax information as specified on the form.

What is the purpose of TN DoR FAE 170?

The purpose of TN DoR FAE 170 is to collect necessary tax information and ensure compliance with state tax obligations for businesses in Tennessee.

What information must be reported on TN DoR FAE 170?

The TN DoR FAE 170 requires reporting information such as business income, expenses, deductions, and any other relevant financial details needed to assess tax liability.

Fill out your TN DoR FAE 170 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TN DoR FAE 170 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.